10 Reasons Why SMEs Should Utilize Export Financing For International Trade

3/6/2023

Share on:

The global export market saw a CAGR of 26.51% from 2020 to 2022, with the market value increasing from USD 17,648.397 billion in FY 2020-21 to USD 22,328.088 billion in FY 2021-22. Similarly, the Indian export market witnessed an impressive CAGR of 44.1% during the same period, increasing from USD 274.410 billion in FY 2020-21 to USD 395.425 billion in FY 2021-22. These stats highlight the immense potential of export financing for SMEs looking to expand into international markets.

Export financing is a type of funding that can help SMEs to access working capital, reduce reliance on loans, and manage cash flow more effectively. For instance, international factoring is an effective form of export financing that allows businesses to grow by giving them access to quick and affordable financing. SMEs can use export financing to fund the production and shipment of goods or services overseas and receive quick access to working capital. Moreover, this type of financing often includes credit insurance, providing additional protection against non-payment from buyers.

It is essential for SMEs to consider export financing as a tool to expand their operations in international markets. From improved cash flow management to increased cash reserves, export financing offers a range of benefits that can help make businesses more profitable and sustainable. In the following sections, we explore ten reasons why SMEs should consider utilizing export financing for international trade.

What is International Factoring?

International factoring is a type of export financing designed to assist SMEs in making the most out of their international trade opportunities. It enables businesses to:

- Receive advance payments for goods and services sold in foreign markets.

- Enables them to quickly access working capital that can be used to grow their operations.

When SMEs sell goods or services to foreign buyers, they often do so on credit – receiving payments from buyers at a future date. The delay in receiving these payments can negatively impact cash flow and working capital, two critical resources needed for SMEs to grow and succeed. International factoring helps businesses receive advance payments for goods and services sold in foreign markets, enabling them to quickly access the working capital that can be used to grow their operations.

How does International Factoring work?

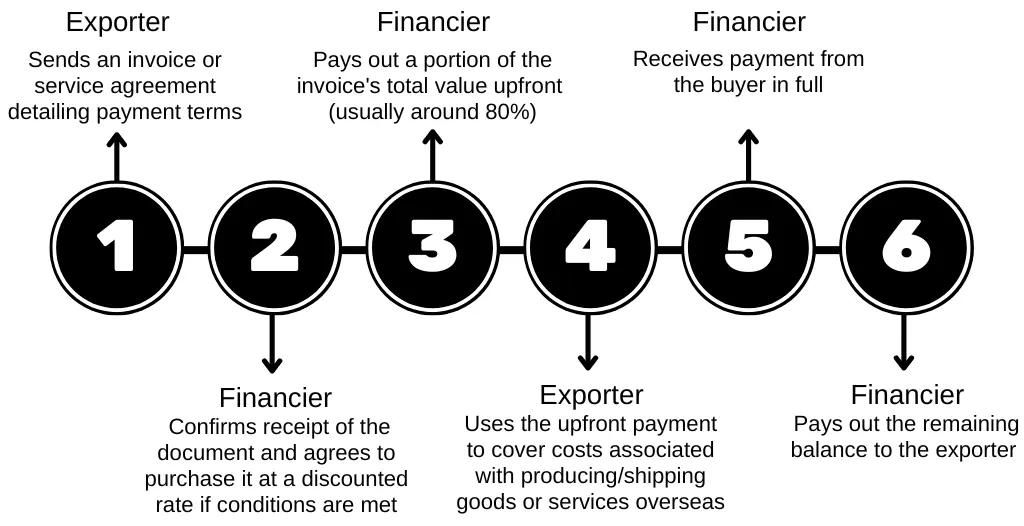

Export factoring is a financing method in which a company sells its invoices to an international financier who pays out a percentage of the invoice value as soon as the invoice is issued. The financier assumes responsibility for collecting payment from the buyer.

Understanding the Process: A Step-by-Step Guide

The process of international factoring involves three main parties:

- The buyer (or importer)

- The seller (or exporter)

- The financier (or factor)

10 Benefits of International Factoring for Small and Medium-sized Enterprises

There are numerous benefits that international factoring can provide for small and medium-sized enterprises looking to expand their business overseas. These include:

1. Access to Affordable Financing

SMEs looking for cost-effective financing options often turn to export credit agencies or other lenders for support. Such organizations have the expertise to assess a customer’s creditworthiness and offer loans with flexible repayment terms, making it easier for SMEs to access low-cost finance.

2. Insurance against Non-Payment Risk

International factoring also protects against non-payment by customers or buyers, allowing businesses to receive cash flow immediately and minimize their exposure to risk while trading in foreign markets.

3. Global Reach

Utilizing export finance makes it possible for SMEs of all sizes to access new international markets without having to carry all the financial burdens on their own. Export financing can help facilitate cross-border transactions by providing necessary capital and improving cash flow management, allowing the business to focus on expanding its operations abroad.

4. Fast Payment Cycles

Quick payment cycles are another advantage of export finance, as they allow small businesses to be paid more quickly than traditional methods of payment like letters of credit or bank transfers. By speeding up the process, customers receive prompt payment and there’s no need for them to wait long periods of time before being paid by their buyers abroad.

5. Credit Assessment Expertise

Leveraging the expertise of experienced and reputable players such as KredX in assessing credit risks internationally, and through the use of state-of-the-art AI techniques, you can reduce exposure to bad debt losses while at the same time ensuring indemnities are kept current in case of unforeseen events.

6. Improved Cash Flow Management

Export finance offers improved cash flow management which is essential if you’re selling goods or services abroad – especially when buyers are located in different time zones around the world. With better cash flow management comes increased profits and more efficient operations which can only help your business grow faster globally.

7. Increased Cash Reserves

Export financing also provides businesses with more working capital which translates into higher cash reserves – something which most SMEs can benefit from greatly. Having greater cash reserves gives businesses more flexibility in meeting their short-term obligations or even taking advantage of new opportunities.

8. Lower Transaction Costs

Export financing helps lower transaction costs associated with doing business internationally. Since platforms like KredX GTX are experts at negotiating agreements with foreign customers, companies will often pay less than what they would have otherwise had to pay when dealing directly with overseas buyers.

9. Reduced Foreign Exchange Volatility

As we all know, currency exchange rates can be volatile. By using export factoring methods such as Letters Of Credit (LOC), businesses can hedge against this risk by locking in favorable exchange rates over pre-defined periods – thus eliminating potential losses associated with fluctuations in currencies over time.

10. Transparency & Efficiency

Export financing offers improved transparency & efficiency when processing payments between two parties in different countries. With better visibility into each side’s respective operations, it becomes much simpler to reconcile accounts as well as identify discrepancies, if any, quickly & easily – saving both parties valuable time & resources in the process!

Conclusion

International factoring provides SMEs with a great opportunity for expanding their business into global markets without taking on too much risk associated with foreign trade transactions due its flexible payment terms and protection against non-payment by customers or buyers. Export financing offers numerous advantages that small & medium-sized enterprises should consider when looking into expanding their operations globally.

From affordable financing options & insurance policies against non-payment risks; global reach & fast payment cycles; reduced transaction costs & foreign exchange volatility; improved transparency & efficiency – these are just some of the many benefits that come with utilizing export financing for international trade.

Share On:

Saddam Hussain

Saddam Hussain is a digital marketing and supply chain finance expert with over a decade's working experience. He specializes in areas such as invoice discounting, working capital management, cash flow forecasting, and risk mitigation and is passionate about sharing his knowledge and expertise with others. His writing is clear, concise, and accessible to both finance professionals and business owners. He believes supply chain finance is a crucial component of any successful business. His goal is to empower readers with the knowledge and tools they need to achieve these goals. When he's not writing or consulting, he enjoys traveling and trying new foods. You can reach him through LinkedIn or Twitter for a quick chat.