In the dynamic world of international trade, Export Credit Agencies (ECAs) play a pivotal role in facilitating commerce across borders. These agencies are often the unsung heroes behind many successful global trade transactions, providing crucial export financing and trade finance solutions. In this blog post, we will delve deep into the world of ECAs, their services, and their profound impact on global trade.

Key Takeaway

- Export credit agencies (ECAs), which provide crucial financial and risk management services, are critical in promoting international trade.

- To address the needs of companies involved in international trade, ECAs offer a variety of services, such as export finance, credit insurance, and investment guarantees.

- Reduce the risks involved in international trade, such as non-payment, political unrest, and economic ambiguity. This is the main responsibility of ECAs.

- Support from ECAs plays a significant role in economic growth since it encourages businesses to expand internationally, which fosters development and the creation of new jobs.

- By reducing trade-related risks, ECAs play a critical role in enhancing trade resilience and promoting the stability of global trade even during turbulent times.

- Due to their global operations and ability to connect businesses with opportunities around the world, ECAs are able to assist businesses in navigating the complexities of international trade.

Understanding Export Credit Agencies

Export credit agencies are specialized, government-backed institutions that encourage and support exports by providing financiers and exporters with options.

The export credit agencies can be split into two groups: government ECAs and private ECAs.These organizations support companies engaged in international trade and cater to many industries and sectors.

Official ECAs are usually owned or backed by governments. They provide services like export credit insurance, export credit guarantees, and direct loans to domestic companies engaged in global trade. These services are designed to make it easier and safer for businesses with offices abroad to do transactions.

On the other hand, private ECAs are privately owned businesses. Although they provide comparable services to official ECAs, they are not connected to the government.

Private ECAs also assist businesses in managing the risks and finances associated with international trade, but they operate independently from government control.

Offerings of Export Credit Agencies

Export Credit Agencies offer a range of services and support mechanisms to facilitate international business transactions.

Some of the primary offerings of ECAs include:

1. Export Financing

ECAs extend financial assistance to domestic companies, exporters, and foreign buyers. This assistance can take the form of loans, credits, or guarantees, helping to bridge financial gaps and reduce risks associated with international trade.

2. Export Credit Insurance

ECAs offer export credit insurance to safeguard exporters against the risk of non-payment or default by foreign buyers. This insurance ensures that exporters receive payment for their goods or services, even if the buyer encounters financial difficulties.

3. Political Risk Insurance

ECAs provide political risk insurance to protect investors and exporters from potential losses due to political events in foreign markets. This coverage includes risks such as expropriation, political instability, war, civil unrest, or trade restrictions.

4. Working Capital Loans

Exporters may be eligible for working capital loans from ECAs to help with production and delivery costs for their exported goods and services. These loans may be utilized for purchasing raw materials, paying for production charges, and other operational requirements.

5. Project Finance Support

Large-scale infrastructure projects abroad are heavily reliant on the funding provided by ECAs. For the success of complicated, long-term investments, they can offer loans or guarantees.

6. Trade Promotion and Market Access

ECAs assist exporters by identifying new markets, helping them understand trade regulations, and navigating the complexities of international trade. They also offer advisory services and market research to support global expansion efforts.

7. Pre-Shipment and Post-Shipment Financing

These are valuable services provided by export credit agencies. These services assist exporters in meeting their commitments to international customers and ensuring that they can deliver goods promptly.

Impact of ECAs on International Trade

Export Credit Agencies (ECAs) exert a noteworthy influence on the world of international trade, and their impact can be viewed from several angles:

1. Facilitating International Trade

ECAs serve as a catalyst for international trade by providing financial assistance and risk management tools to businesses. This support encourages companies to venture into the global marketplace, resulting in increased exports and imports. As a result, this dynamic promotes wealth and economic progress on a worldwide level.

2. Facilitating Market Entry

Due to perceived dangers, it can be difficult for small and medium-sized businesses (SMEs) to join overseas markets. ECAs play a pivotal role in mitigating these risks by offering insurance and guarantees. This empowers SMEs to compete effectively with larger corporations in the international arena, leveling the playing field.

3. Nurturing Economic Expansion

ECAs extend their support to development projects in developing countries. These schemes not only make international trade easier but also create jobs and encourage the expansion of regional industries. Additionally, infrastructure improvement supports the general economic stability of these areas, fostering long-term development.

4. Stabilizing Financial Transactions

By providing insurance against various trade-related risks, ECAs enhance the financial stability of global trade. This reassurance encourages investors and financial institutions to participate in international transactions, contributing to a reduction in financial volatility on a global scale.

5. Mitigating Global Economic Challenges

During times of economic downturns and crises, ECAs play a crucial role by offering financial assistance and liquidity to exporters. This intervention helps maintain the flow of trade and prevents crises from escalating further, thus promoting economic resilience during turbulent periods.

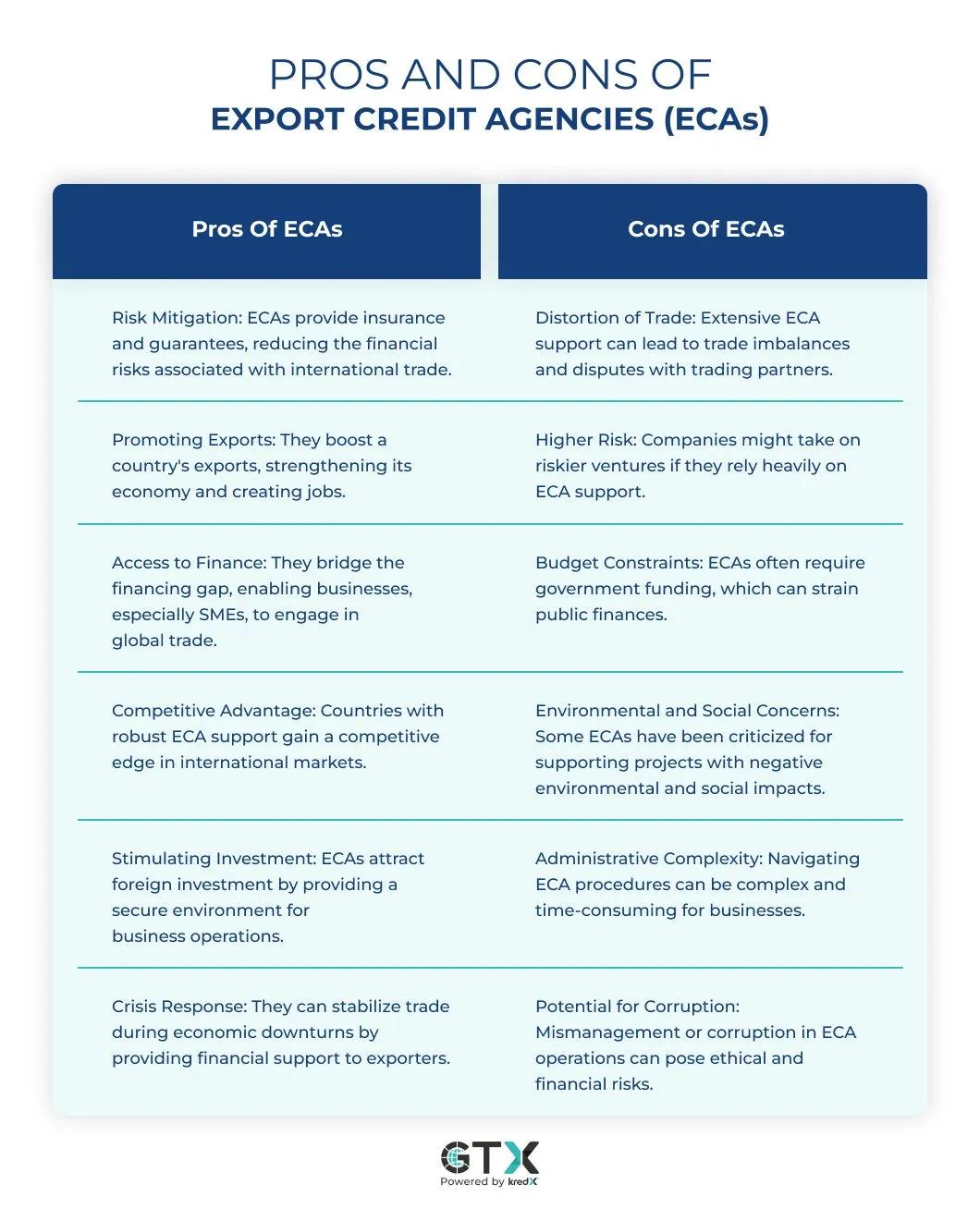

Pros and Cons of Export Credit Agencies (ECAs)

Conclusion

Export Credit Agencies, which provide export financing and trade finance solutions that support the global economy, are a crucial force in the realm of international trade. They support global economies, investors, and exporters in a crucial way, fostering sustainability, stability, and prosperity.

The future of ECAs appears bright, notwithstanding the difficulties and critiques they encounter. They play a key role in enabling international trade and lowering risks, making them crucial partners for businesses trying to flourish in the global economy.

Frequently Asked Questions on Export Credit Agency

1. What is the role of an export credit agency?

ECAs play several roles, including providing export financing, offering insurance against non-payment by foreign buyers, and promoting and facilitating exports by domestic companies.

2. How do export credit agencies help exporters?

ECAs help exporters by providing them with financing, export credit insurance, and guarantees to mitigate risks associated with international trade, making it easier for them to enter and compete in foreign markets.

3. What types of financial products do ECAs offer?

ECAs typically offer a range of financial products, including export credit insurance, export credit guarantees, working capital financing, and project financing for large export-related projects.

4. How do export credit agencies benefit the domestic economy?

ECAs can boost domestic economic growth by promoting exports, creating jobs, and facilitating foreign investment. They also help mitigate risks for domestic companies engaged in international trade.

5. What is the relationship between export credit agency and trade finance?

The role of ECAs in trade finance is significant because they offer financing options that allow exporters to be paid for their goods and services even in the event of buyer default or other political or commercial risks.

6. Can export credit agencies help small and medium-sized businesses (SMEs)?

Yes, many ECAs offer programs specifically designed to help SMEs access export financing and insurance, as these businesses often face greater challenges when entering international markets.

Share On:

Saddam Hussain

Saddam Hussain is a digital marketing and supply chain finance expert with over a decade's working experience. He specializes in areas such as invoice discounting, working capital management, cash flow forecasting, and risk mitigation and is passionate about sharing his knowledge and expertise with others. His writing is clear, concise, and accessible to both finance professionals and business owners. He believes supply chain finance is a crucial component of any successful business. His goal is to empower readers with the knowledge and tools they need to achieve these goals. When he's not writing or consulting, he enjoys traveling and trying new foods. You can reach him through LinkedIn or Twitter for a quick chat.