Export Factoring or PO Finance: Choosing the Right Fit for Manufacturers

8/22/2025

Share on:

Manufacturers often encounter working capital gaps when fulfilling export orders. These gaps arise because production and delivery require upfront costs, while payment from buyers is often delayed due to extended credit terms. To better manage cash flow and sustain operations, many manufacturers turn to financing solutions. Two common options are export factoring and purchase order (PO) finance. Understanding how each works can help manufacturers choose the best option for their business.

What is Export Factoring?

Export Factoring allows manufacturers to sell their export invoices to a factoring company at a discount. After shipping goods and generating invoices, the manufacturer receives an immediate advance (usually 80-90% of the invoice value) from the factor. The factor then takes responsibility for collecting payments from overseas buyers.

Benefits of Export Factoring for Manufacturers

Improved Cash Flow: Converts receivables into immediate working capital.

Outsourced Credit Control: The factor handles collections and credit risk assessment.

No Collateral Required: Financing is based mainly on the buyer’s creditworthiness.

Focus on Core Operations: Manufacturers can focus on production without worrying about payment delays.

What is PO Finance?

Purchase Order (PO) finance provides manufacturers with funding based on confirmed purchase orders. Lenders finance the cost of fulfilling the orders, such as raw materials and labor, before shipment. Once the order is completed and invoiced, the manufacturer repays the loan from the buyer’s payment proceeds.

Benefits of PO Finance for Manufacturers

Pre-Shipment Funding: Access to working capital before production starts.

No Need to Use Own Capital: Helps manage cash flow without tying up internal resources.

Supports Larger Orders: Enables manufacturers to take larger or more orders than they could self-finance.

Reduces Supply Chain Disruptions: Ensures timely procurement and production.

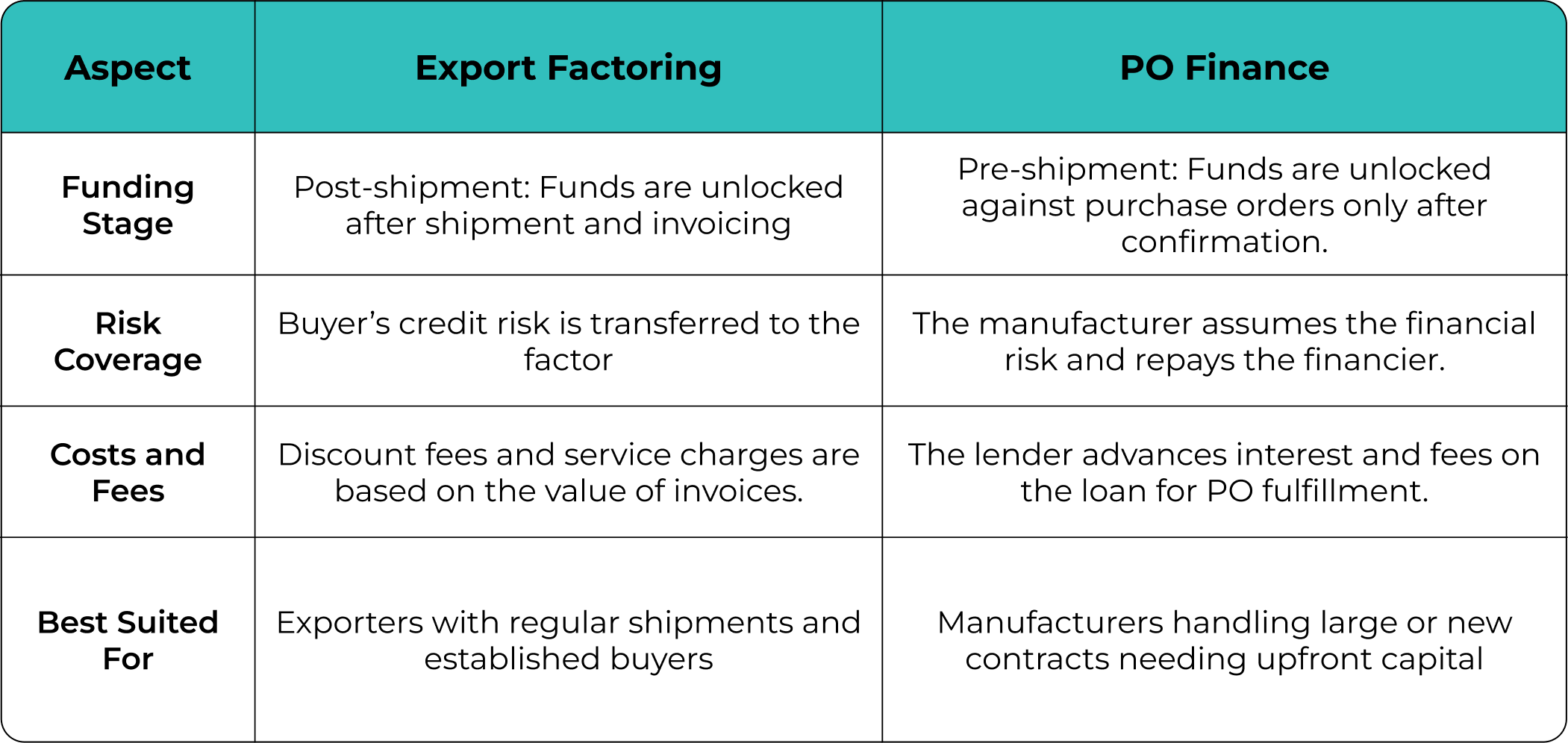

Differences Between Export Factoring and PO Finance

When to Opt for Export Factoring

Export factoring is most suitable in scenarios where exporters seek post-shipment liquidity and risk mitigation. This solution accelerates cash flow by converting outstanding invoices into immediate funds. It also helps to protect businesses against buyer default risk and credit risk management for the factoring company. With export factoring, manufacturers can gain faster access to working capital while reducing the burden of chasing payments.

When to Choose PO Finance

PO financing is ideal for exporters facing pre-shipment capital gaps. It is the right choice when the manufacturers receive large export orders but lack the upfront capital to fulfill them. This financing option provides the liquidity needed to purchase raw materials or pay suppliers before shipping, so manufacturers can focus on operations.

Documentation and Process

Export factoring needs invoices, export contracts, and shipping documents. PO Finance requires purchase orders, supplier quotes, and proof of manufacturing capacity. Being prepared with accurate paperwork accelerates financing approvals and reduces delays.

Risk and Cost Considerations

Export factoring carries discount and service fees based on the invoice amounts, often balanced by credit protection benefits. PO Finance, on the other hand, costs more due to the financier’s upfront liability but can unlock larger growth potential when large orders are intact.

Choosing the Right Fit for Your Manufacturing Business

Export factoring suits exporters focused on quick cash flow and credit risk coverage, while PO finance fits manufacturers keen to scale using confirmed but capital-intensive orders.

By choosing wisely, manufacturers can fortify their financial stability, unlock growth opportunities, and build credibility in global markets. Our tailored solutions like GTX by KredX streamline working capital access, helping you grow internationally with confidence. Contact us to learn how we can support your export financing needs.

Share On:

Anurag Jain

Anurag Jain, is the co-founder and Executive Director of KredX. An IIT Kanpur alumnus and a techie-turned-entrepreneur with two decades of experience in the financial services sector, he drove business growth in companies like HSBC, Oracle, and Tavant Technologies, before co-founding KredX, in 2015. You can connect with him on LinkedIn to know more.