What is HSN Code?

HSN code full form– Harmonized System of Nomenclature is a globally accepted product coding system. The World Customs Organization (WCO) introduced this 6-digit code in 1988 as a global standard for classifying goods. It categorises over 5000 products and is crucial for taxation purposes.

India has been using HSN codes for a long time to classify various commodities for Customs and Central Excise. People use these codes in Customs tariff and for filing GST. Today, businesses must include HSN in B2B (business-to-business) and B2C (business-to-consumer) invoices for supplies of goods and services.

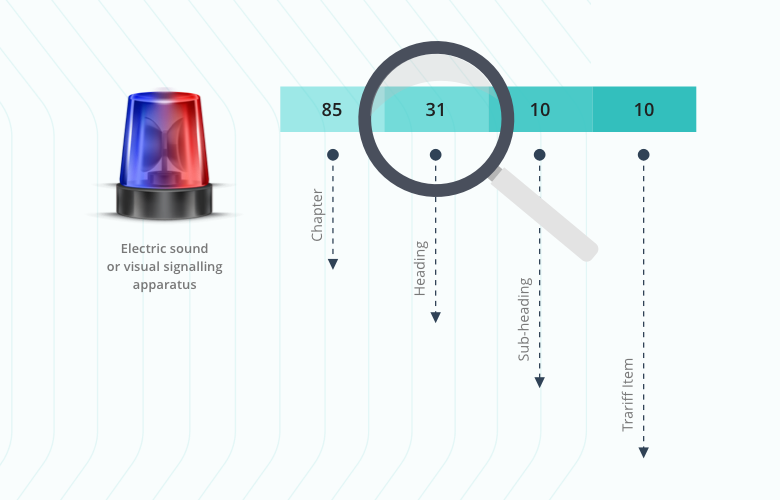

Structure Of HSN Code

How Does The HSN Code Work?

The HSN codes contain 21 sections, within which there are 99 chapters, approximately 1,244 headings and 5,224 subheadings. Thus, each section number is divided into chapters, which are further divided into headings and subheadings. The sections and chapters describe a specific product while the other two divisions provide more details about it.

For example, there is a particular product with the HSN- 62.13.90. Let us see what product it refers to using the HSN code–

- The first two digits (62) refer to the chapter number for clothing and apparel accessories that are not knitted/crocheted.

- After that, (13) refers to a specific article of clothing, i.e. handkerchiefs.

- The following two digits (90) refer to the fact that this handkerchief is made from textile fibres.

HSN CODE TABLE

Understanding The Rules Of HSN Codes In India

India has been a member of WCO since 1971 and thus, used the 6-digit HSN codes to classify goods for Customs and Central Excise. Later, Customs added two digits for a more precise 8-digit HSN code.

For the earlier example, one can use two more digits to sub-classify the product tariff heading during exports/imports.

- The HSN code will be 62.13.90.10 for man-made fibres, handkerchief.

- In case the handkerchief is made of other textile materials, the HSN will be 62.13.90.90

With the introduction of Goods and Services Tax (GST), India has introduced a 3-tier system with the following rules-

- Businesses dealing with exports and imports must use 8-digit HSN codes.

- As of 1st April 2021, businesses with a turnover of more than Rs. 5 crores must use 6-digit HSN codes.

- Businesses with a turnover of up to Rs. 5 crores must furnish 4-digit HSN codes on B2B invoices. Declaring HSN is optional for these companies for B2C tax invoices.

Previously, the requirements for businesses with turnovers of over Rs. 5 crores and those between Rs. 1.5-5 crores were 4-digit and 2-digit, respectively.

Importance Of HSN Codes

Around 98% of international trade stocks are classified using the HSN codes. Its primary function is to classify goods systematically and logically to facilitate world trade. More than 200 countries use this system due to its many benefits, such as:

- Helps to collect international trade statistics

- Uniform classification system

- Provides a rational basis for custom tariffs

Businesses use HSN codes in all manner of trading, from animal products, plastic items, clothing to arms and ammunition, machinery etc. The introduction of the globally accepted HSN codes has made it easy to identify goods, reducing errors with identification. Moreover, it has minimised expenses involved in trading and simplified the customs procedure.

HSN codes have also made GST more systematic and acceptable worldwide. As the same numbers are used to classify commodities for customs, GST and trading, there is no need to upload details about goods. One can simply check the GST rate for HSN codes from the CBIC (Central Board of Indirect Taxes and Customs) website making tax filing much easier.

With manufacturers, traders and service providers submitting precise HSN codes, tax officers can get more accurate information about tax filing. In addition, they can use their data analytics for supplied items to prevent tax evasion made using fake invoices and irregular tax credit claims.

Online platforms like KredX offer invoice discounting, where companies can get immediate working capital using their unpaid invoices. Along with this product, it also provides end-to-end invoice management, which will ensure that there are no tax arrears.

What Is The SAC HSN Code?

Like goods, services can also be classified uniformly for measurement, identification and taxation purposes. People can use an SAC (Services Accounting Code) to classify services. The CBIC has issued this code to classify all types of services under GST.

Each service listed under GST has a unique SAC. For example, the SAC- 998213 represents the service of legal documentation and certification concerning copyrights, patents and other intellectual property rights.

The following is a breakdown of this number-

- 99 is a number that represents all services

- The second two digits (82) represent the category of service, i.e., in this case, legal services.

- The next two digits (13) give a detailed description of the service, i.e., legal documentation for patents.

Businesses should use these SAC codes in their invoices for taxation purposes. Like HSN codes, the CBIC website also has a ‘services’ section. Here people can look at applicable GST rates in India for various services using the search function.

Understanding The Basics of GST In India

GST is an indirect tax that replaced many indirect taxes like VAT, service tax, excise duty etc. GST is a single, multi-stage, destination-based tax applicable for every value addition and is uniform for the entire country. The Indian Government introduced GST in 2017 to eliminate tax inefficiencies and cascading taxes.

Almost all goods and services in India are classified using the HSN or SAC code system for GST calculations. There are five different slabs of GST percentage in India for goods and services- Nil, 5%, 12%, 18% and 28%.

With the introduction of GST, every state has to follow a single tax for a particular product and service. Not only has this made tax administration more manageable, but it has increased tax compliance as taxpayers are not troubled by tedious paperwork and multiple deadlines.

There are three main taxes under the GST regime. These are:

- CGST: The Central Government collects this portion of GST on intra-state sales.

- SGST: The State Government collects this portion on all goods and services supplied for consideration. Both the Central and State Government shares the revenue equally for intra-state transactions.

- IGST: The Central Government collects this tax for inter-state sales and shares the revenue based on the destination of the sale.

Traders all over the world use HNS codes to classify goods systematically. India has adopted this code as a standard for purposes of trade and taxation. HSN classifies commodities using an 8-digit code into various sections, chapters, headings and subheadings for convenience. Under the GST regime, suppliers have to display the HSN code or SAC code on invoices of goods/services. One can find this in the HSN code list of CBIC’s official website. To make sure that their invoices are 100% correct for taxation, businesses may want to get professional invoice management from reputed platforms like KredX.

Frequently Asked Questions

What is the use of the 8-digit HSN code?

The Customs and Central Excise added two more digits to the standard 6-digit HSN code for better classification. Companies dealing with exports/imports typically print 8-digit HSN codes.

Who has to declare the HSN code and when?

Companies with a turnover of over Rs. 5 crore will have to furnish their 6-digit HSN code on invoices and report them when filing GST returns. Companies with less than Rs. 5 crore turnovers need to furnish their 4-digit HSN code.

Who is liable to pay GST in India?

Companies and traders with annual sales above Rs. 20 lakh must pay GST. For the north-eastern and special category states, this threshold is Rs. 10 lakh.

Where can I know the HSN code of a particular product?

You can view the HSN code list on the Indian Government's GST website. Scroll down to find the product based on chapter/heading number or use the HSN code search.