Global business thrives on a complex system of trade. Every item bought, and every service rendered, has a story of transactions, risks, and financial maneuvers behind it. These processes, often invisible to the consumer, are vital for the health and vibrancy of international markets. Two of the critical pillars in this system are trade and export finance. Let's shed light on their distinctive roles.

Key Takeaways

- Trade finance broadly supports and facilitates international trade between buyers and sellers, while export finance focuses predominantly on aiding exporters.

- Key instruments like letters of credit (LCs), bank guarantees, trade credit, and documentary collections play a pivotal role in facilitating and securing trade transactions.

- Potential challenges in global trade financing include credit risk, interest rate fluctuations, geopolitical disruptions, and legal ambiguities across borders.

- The future of trade and export finance will be significantly influenced by digitalization, sustainability, and changing geopolitics leading to regionalization.

- Both trade and export finance serve as essential mechanisms to mitigate risks in international commerce, ensuring a smoother flow of goods and capital across borders.

Trade Finance: The Backbone of Global Trade

At its core, trade finance supports and facilitates international trade between buyers and sellers. It seeks to mitigate risks associated with global business, ensuring both parties can trust the process and each other.

Key instruments of trade finance include

1. Letters of Credit (LCs)

Bank guarantees that sellers receive payment as long as specific delivery conditions are met.

2. Bank Guarantees

A promise from a lending institution ensures a seller receives payment, even if the buyer defaults.

3. Trade Credit

This allows businesses to buy goods and defer payment, boosting their operational flexibility

4. Documentary Collections

A bank acts as an intermediary ensuring that all trading documents are in order.

Export Finance: Bolstering Exporters' Endeavors

While trade finance offers a broad spectrum of services, export finance narrows its focus predominantly on the exporter. It's all about supporting and aiding businesses in exporting their goods and services overseas.

Here are the significant facets of export finance -

1. Export Credits

A loan or advance given to the exporter, against the value of the goods shipped.

2. Export Credit Insurance

A safeguard for exporters against potential losses from non-payment by overseas buyers.

3. Pre-shipment Financing

Funds are provided to exporters before their goods are shipped, helping them manage production and assembling costs.

4. Post-shipment Financing

Financing is provided once goods are shipped and before the final payment is received, aiding in cash flow management.

Comparing and Contrasting: Trade Finance vs. Export Finance

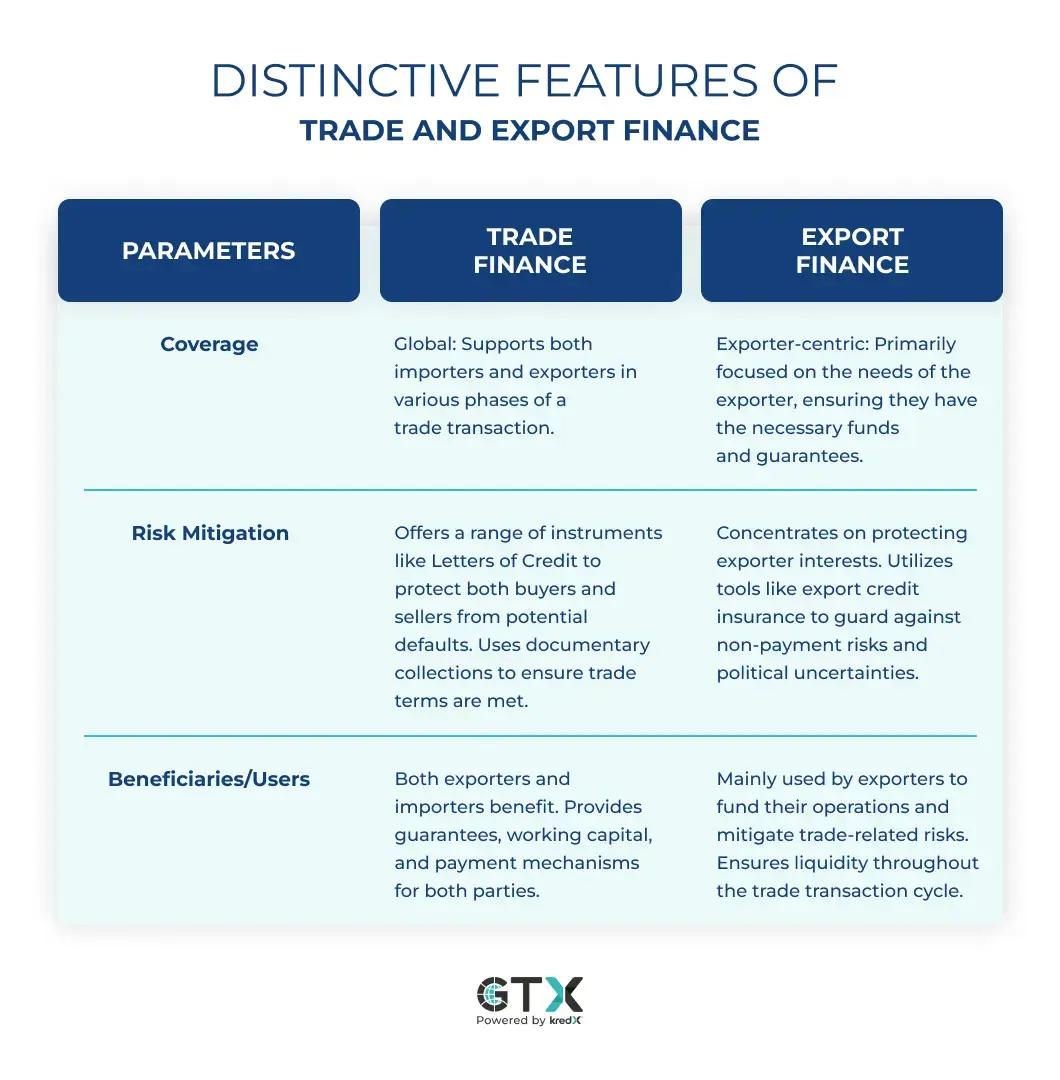

The spheres of trade and export finance often overlap, yet they possess distinctive characteristics. Here’s a detailed look at these differences:

Overlap Between Trade and Export Finance

Trade and export finance are mechanisms designed to support and facilitate international business transactions. They ensure that sellers receive their payments and buyers get their goods or services. These systems often interplay as they address the varied challenges associated with global trade, such as currency fluctuations, political risks, and the trust gap between unfamiliar parties.

Distinctive Features of Trade and Export Finance

Navigating the Rough Seas: Challenges and Precautions

Trade and export finance aren't without their challenges. Currency fluctuations, geopolitical issues, and default risks are real threats. However, by utilizing the right financial tools and staying informed, businesses can safeguard against most pitfalls.

Potential Pitfalls in Trade Finance

1. Credit Risk

There's always a possibility that the buyer (importer) might default on payment. This can be due to various reasons ranging from insolvency to cash flow problems.

2. Interest Rate Risk

Fluctuations in interest rates can affect the cost of financing, especially for long-term transactions.

3. Foreign Exchange Risk

Currency value fluctuations can cause unexpected losses, especially if a business is dealing in multiple currencies.

4. Country and Political Risks

Unstable political environments or stringent regulations in a buyer's or seller's country can disrupt transactions.

Risks Associated with Export Finance

1. Non-Payment

The risk is that the overseas buyer defaults on payment post-shipment.

2. Supply Chain Disruptions

Delays or failures in shipment, leading to non-fulfillment of contractual obligations.

3. Country Risk

Potential financial loss due to abrupt changes in a foreign country's government policy or political unrest.

4. Contractual and Legal Risks

Different countries have varied legal systems, which can pose challenges in case of disputes.

Best Practices for Risk Management in Export and Trade Finance

Safeguarding interests in export and trade finance demands a blend of meticulous credit checks, leveraging fail-safe payment tools like letters of credit, and diversifying trading venues. Equally essential is the strategic management of currency shifts and the adoption of ample trade insurance coverage.

1. Thorough Due Diligence

Consistently gauging the financial reliability of trading counterparts helps in anticipating potential payment defaults. Periodic creditworthiness checks and understanding the financial health of partners can fortify trade relationships.

2. Hedging Strategies

Currency and interest rate volatility can pose significant financial risks in international trade. By using hedging tools, businesses can stabilize their finances, safeguarding them against sudden and unfavorable market shifts.

3. Insurance Coverage

Trade credit insurance acts as a safety net, ensuring businesses get compensated in the event of non-payment. It not only mitigates risks of payment defaults but also empowers businesses to explore new markets with confidence.

4. Market Diversification

Relying heavily on a single market can amplify risks associated with economic downturns or geopolitical issues. Spreading trade engagements across diverse markets provides a buffer, ensuring a revenue stream even if one market faces challenges.

5. Unambiguous Contractual Agreements

Clearly defined contracts prevent misunderstandings, ensuring all parties have the same expectations regarding deliverables and payments. A well-constructed contract can be a decisive tool in avoiding disputes and maintaining a healthy business relationship.

Trends Shaping the Future of Trade and Export Finance

Technology is reshaping how we perceive trade and export finance. Digital platforms, blockchain, and AI are streamlining processes, making transactions swifter and more transparent. As businesses and financial institutions adapt, it's crucial to stay updated and agile.

1. Digitalization

Advancements like blockchain revolutionize how trade transactions are recorded and verified, bringing transparency and efficiency.

2. Sustainability

An increasing push for sustainable trade practices, potentially leading to green trade financing solutions.

3. Regionalization

As geopolitics evolve, there might be a shift towards more regional trade blocs and agreements.

Conclusion

Trade finance and export finance play pivotal roles in the complex domain of international trade. While they have distinctive functions, both aim to facilitate and safeguard global commerce. Their importance is magnified by the myriad challenges that global trade presents, from geopolitical risks to currency fluctuations. As the global trade landscape continues to evolve, so will these financing mechanisms, adapting and innovating to serve the ever-changing needs of businesses worldwide.

Share On:

Saddam Hussain

Saddam Hussain is a digital marketing and supply chain finance expert with over a decade's working experience. He specializes in areas such as invoice discounting, working capital management, cash flow forecasting, and risk mitigation and is passionate about sharing his knowledge and expertise with others. His writing is clear, concise, and accessible to both finance professionals and business owners. He believes supply chain finance is a crucial component of any successful business. His goal is to empower readers with the knowledge and tools they need to achieve these goals. When he's not writing or consulting, he enjoys traveling and trying new foods. You can reach him through LinkedIn or Twitter for a quick chat.